The financial crisis exposed insufficient knowledge of the factors and mechanisms that spread individual and systemic problems in the financial sector. To address these deficiencies and participate in international research activities, the ACPR has been working in recent years to bolster its in-house research and analytical capabilities while at the same time leveraging external partnerships. Its research has looked at sector-specific risks, the performance of stress tests and the coordination of regulatory impact studies. The ACPR also conducts thematic analyses (solvency, liquidity) and comparative studies.

These cross-cutting analyses (across a population of individual institutions) enable supervisors to situate individual institutions relative to the rest of the market, which is a considerable advantage when it comes to ensuring effective supervision and spotting individual weaknesses.

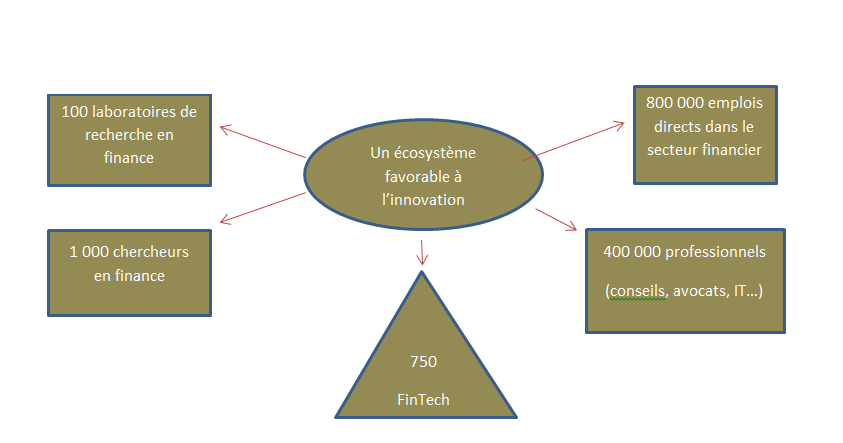

The ACPR also draws on work on supervision provided by external and independent research units. This work is characterised by a scientific approach that is especially rigorous because it is accompanied by greater sharing of data than in the past. Whether regulators agree with them or not, these research findings fuel the public debate and contribute to an adversarial assessment of supervision in the financial sector. These open debates between supervisors, professionals and academics raise the quality of prudential supervision, which thus gains in credibility and effectiveness.

The research and analysis activities of the ACPR consequently help to improve prudential supervision, contributing to strengthen oversight at the operating level.